Details are slim at this point but it is being reported that DC Comics and WB Games have been sold off in some form as a result of the newly announced AT&T WarnerMedia merger with Discovery.

Monday saw the big news (via Deadline) that AT&T has inked a deal to unload WarnerMedia which will merge with Discovery and be led by Discovery’s David Zaslav as chief executive, with WarnerMedia’s Jason Kilar allegedly out the door (via NYTs).

You can read the full press release below which explains that as a result of the WarnerMedia and Discovery merger, a new as of yet unnamed company will be formed that unify brands such as CNN, TBS, TNT, HGTV, Food Network, Discovery Channel, Warner Bros.’ movie studio, and streaming services HBO Max and Discovery+, along with WarnerMedia’s U.S. sports rights such as the MLB, NBA and March Madness with Discovery international sports titan Eurosport (via Observer). WarnerMedia also includes DC Comics and WB Games.

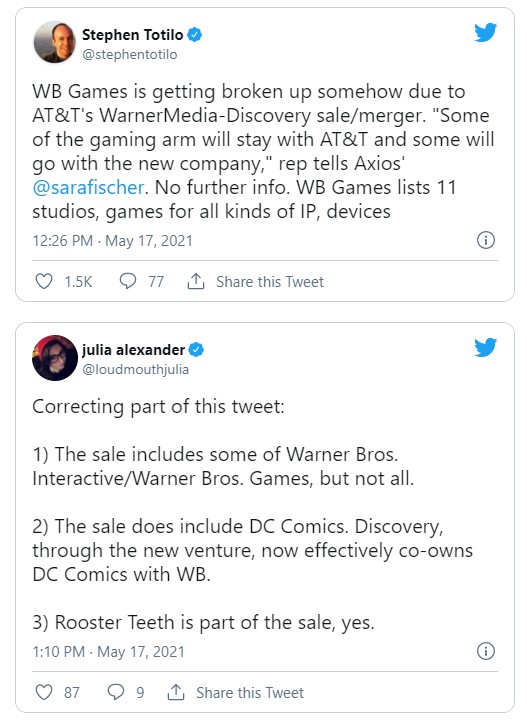

Regarding DC Comics and WB Games, again not confirmed (see tweets below), but it is claimed the sale includes some of WB Games, and that DC Comics will be co-owned by Discovery along with WB.

The news isn’t all that surprising as last June it was reported AT&T was looking to sell WB Games, and Ethan Van Sciver, a former artist at DC Comics, has been right all along when he stated two years ago that AT&T would divest itself of DC Comics as well.

The deal is expected to go through mid-2022, so there is still a while to go, but worth a note is that the new company will not be run by someone from WarnerMedia or WB, but the head of Discovery, David Zaslav.

Update: It is reported that AT&T is exiting the entertainment sector and getting rid of Time Warner.

They mocked me. They scorned me. They belittled me.

But I was right.

All along.

AGAIN. https://t.co/u0HoLl84po pic.twitter.com/ZVUt2Plexj

— KING OF ALL SOCIAL MEDIA (@EthanVanSciver) May 17, 2021

Press Release

AT&T’s WarnerMedia and Discovery, Inc. Creating Standalone Company by Combining Operations to Form New Global Leader in Entertainment

Companies with Shared Values, Complementary Assets, and Iconic Brands and Franchises, Will Offer the Most Differentiated Content Portfolio in the World

WarnerMedia and Discovery, Inc. Form One of the Largest Global Streaming Players

Discovery President & CEO David Zaslav to Lead New Company with Executives from Both Companies in Key Leadership Roles

AT&T and Discovery Will Hold Joint Press Conference at 7:30am EDT and a Separate Call with Investors Will Begin at 8:30am EDT

AT&T Inc. (NYSE:T) and Discovery, Inc. (NASDAQ: DISCA, DISCB, DISCK) today announced a definitive agreement to combine WarnerMedia’s premium entertainment, sports and news assets with Discovery’s leading nonfiction and international entertainment and sports businesses to create a premier, standalone global entertainment company.

Under the terms of the agreement, which is structured as an all-stock, Reverse Morris Trust transaction, AT&T would receive $43 billion (subject to adjustment) in a combination of cash, debt securities, and WarnerMedia’s retention of certain debt, and AT&T’s shareholders would receive stock representing 71% of the new company; Discovery shareholders would own 29% of the new company. The Boards of Directors of both AT&T and Discovery have approved the transaction.

The companies expect the transaction will create substantial value for AT&T and Discovery shareholders by:

- Bringing together the strongest leadership teams, content creators, and high-quality series and film libraries in the media business.

- Accelerating both companies’ plans for leading direct-to-consumer (DTC) streaming services for global consumers.

- Uniting complementary and perse content strengths with broad appeal — WarnerMedia’s robust studios and portfolio of iconic scripted entertainment, animation, news and sports with Discovery’s global leadership in unscripted and international entertainment and sports.

- Forming a new company that will have significant scale and investment resources with projected 2023 Revenue of approximately $52 billion, adjusted EBITDA of approximately $14 billion, and an industry leading Free Cash Flow conversion rate of approximately 60%.

- Creating at least $3 billion in expected cost synergies annually for the new company to increase its investment in content and digital innovation, and to scale its global DTC business.

For AT&T and its shareholders, this transaction provides an opportunity to unlock value in its media assets and to better position the media business to take advantage of the attractive DTC trends in the industry. Additionally, the transaction allows the company to better capitalize on the longer-term demand for connectivity:

- AT&T shareholders participate in a leading media company with a broad global portfolio of brands, tremendous DTC potential and strengthened combined assets.

- Creates substantial value opportunity for AT&T shareholders through stepped-up investment in growth areas – mobile and fixed broadband.

- Capital structure improvement after closing will position AT&T as one of the best capitalized 5G and fiber broadband companies in the United States.

- Results in two independent companies – one broadband connectivity and the other media – to sharpen the investment focus and attract the best investor base for each company.

A Stronger Competitor in Global Streaming

The new company will compete globally in the fast-growing direct-to-consumer business — bringing compelling content to DTC subscribers across its portfolio, including HBO Max and the recently launched discovery+. The transaction will combine WarnerMedia’s storied content library of popular and valuable IP with Discovery’s global footprint, trove of local-language content and deep regional expertise across more than 200 countries and territories. The new company will be able to invest in more original content for its streaming services, enhance the programming options across its global linear pay TV and broadcast channels, and offer more innovative video experiences and consumer choices.

Uniting Dynamic, Enduring and Historic Brands and Franchises

The “pure play” content company will own one of the deepest libraries in the world with nearly 200,000 hours of iconic programming and will bring together over 100 of the most cherished, popular and trusted brands in the world under one global portfolio, including: HBO, Warner Bros., Discovery, DC Comics, CNN, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet, ID and many more.

The new company will be able to increase investment and capabilities in original content and programming; create more opportunity for under-represented storytellers and independent creators; serve customers with innovative video experiences and points of engagement; and propel more investment in high-quality, family-friendly nonfiction content.

Leadership, Governance and Structure

The companies announced that Discovery President and CEO David Zaslav will lead the proposed new company with a best-in-class management team and top operational and creative leadership from both companies.

Discovery’s current multiple classes of shares will be consolidated to a single class with one vote per share.

The new company’s Board of Directors will consist of 13 members, 7 initially appointed by AT&T, including the chairperson of the board; Discovery will initially appoint 6 members, including CEO David Zaslav.

Executive Commentary

John Stankey Said:

“This agreement unites two entertainment leaders with complementary content strengths and positions the new company to be one of the leading global direct-to-consumer streaming platforms. It will support the fantastic growth and international launch of HBO Max with Discovery’s global footprint and create efficiencies which can be re-invested in producing more great content to give consumers what they want. For AT&T shareholders, this is an opportunity to unlock value and be one of the best capitalized broadband companies, focused on investing in 5G and fiber to meet substantial, long-term demand for connectivity. AT&T shareholders will retain their stake in our leading communications company that comes with an attractive pidend. Plus, they will get a stake in the new company, a global media leader that can build one of the top streaming platforms in the world.”

David Zaslav Said:

“During my many conversations with John, we always come back to the same simple and powerful strategic principle: these assets are better and more valuable together. It is super exciting to combine such historic brands, world class journalism and iconic franchises under one roof and unlock so much value and opportunity. With a library of cherished IP, dynamite management teams and global expertise in every market in the world, we believe everyone wins…consumers with more perse choices, talent and storytellers with more resources and compelling pathways to larger audiences, and shareholders with a globally scaled growth company committed to a strong balance sheet that is better positioned to compete with the world’s largest streamers. We will build a new chapter together with the creative and talented WarnerMedia team and these incredible assets built on a nearly 100-year legacy of the most wonderful storytelling in the world. That will be our singular mission: to focus on telling the most amazing stories and have a ton of fun doing it.”

Transaction Highlights

The combination will be executed through a Reverse Morris Trust, under which WarnerMedia will be spun or split off to AT&T’s shareholders via pidend or through an exchange offer or a combination of both and simultaneously combined with Discovery. The transaction is expected to be tax-free to AT&T and AT&T’s shareholders.

In connection with the spin-off or split-off of WarnerMedia, AT&T will receive $43 billion (subject to adjustment) in a combination of cash, debt securities and WarnerMedia’s retention of certain debt. The new company expects to maintain investment grade rating and utilize the significant cash flow of the combined company to rapidly de-lever to approximately 3.0x within 24 months, and to target a new, longer term gross leverage target of 2.5x-3.0x. WarnerMedia has secured fully committed financing from JPMorgan Chase Bank, N.A. and affiliates of Goldman Sachs & Co. LLC for the purposes of funding the distribution.

The transaction is anticipated to close in mid-2022, subject to approval by Discovery shareholders and customary closing conditions, including receipt of regulatory approvals. No vote is required by AT&T shareholders. Agreements are in place with Dr. John Malone and Advance to vote in favor of the transaction.

AT&T Preliminary Financial Profile Following Completion of the Transaction; Focused Total Return Strategy for Capital Allocation; After Close, pidend Payout Ratio1 Expected to be Low 40s%.

After close and on a pro-forma basis, AT&T expects its remaining assets to produce the following financial trajectory from 2022 to 2024:

- Annual revenue growth: low single digits CAGR2

- Annual adjusted EBITDA3 and adjusted EPS4 growth: mid-single digits CAGR

- Significantly increased financial flexibility to drive returns to shareholders, including:

- Expected increased capital investment for incremental investments in 5G and fiber broadband. The company expects annual capital expenditures of around $24 billion once the transaction closes. AT&T expects its 5G C-band network will cover 200 million people in the U.S. by year-end 2023. And the company plans to expand its fiber footprint to cover 30 million customer locations by year-end 2025.

- Significant debt reduction: Expect Net Debt to Adjusted EBITDA5 in the 2.6x range after transaction closes and less than 2.5x by year end 2023.

- Attractive pidend – resized to account for the distribution of WarnerMedia to AT&T shareholders. After close and subject to AT&T Board approval, AT&T expects an annual pidend payout ratio of 40% to 43% on anticipated free cash flow1 of $20 billion plus.

- The optionality to repurchase shares once Net Debt to Adjusted EBITDA is less than 2.5x.

Advisors

LionTree LLC and Goldman Sachs & Co. LLC served as financial advisors and Sullivan & Cromwell LLP served as legal advisor to AT&T.

Allen & Company LLC and J.P. Morgan Securities LLC served as financial advisors and Debevoise & Plimpton LLP served as legal advisor to Discovery. Peralla Weinberg Partners and Wachtell Lipton, Rosen & Katz served as advisors to the Independent Directors of Discovery.

RBC Capital Markets served as financial advisors and Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal advisors to Advance.

Media Availability and Investor Call

AT&T and Discovery will hold a joint press conference at 7:30am EDT, and a separate call with investors will begin at 8:30am EDT today. The webcast of the call and related materials will be available on AT&T’s and Discovery’s Investor Relations websites at https://investors.att.com/ and https://ir.corporate.discovery.com/investor-relations.

Join the 7:30am EDT press conference with John Stankey and David Zaslav on Zoom by clicking here. Your camera will be disabled and microphones will be automatically muted. To ask a question, please select the “raise hand icon.” When you are called on, you will receive a prompt asking you to unmute your microphone. The Zoom Webinar ID is 985 9072 9554; the passcode is 866906.

1. pidend payout ratio is total pidends paid pided by free cash flow. Free cash flow is a non-GAAP financial measure that is frequently used by investors and credit rating agencies to provide relevant and useful information. Free cash flow is cash from operating activities minus capital expenditures. Due to high variability and difficulty in predicting items that impact cash from operating activities and capital expenditures, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP metric without unreasonable effort.

2. Compound annual growth rate.

3. EBITDA is operating income before depreciation and amortization.

4. The company (AT&T) expects adjustments to 2021-2024 reported diluted EPS to include merger-related amortization ($4.3 billion for 2021 and approximately $1 billion per quarter in 2022 until closing of the transaction) and other adjustments, a non-cash mark-to-market benefit plan gain/loss, and other items. The company expects the mark-to-market adjustment, which is driven by interest rates and investment returns that are not reasonably estimable at this time, to be a significant item. AT&T’s 2021 EPS depends on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between these projected non-GAAP metrics and the reported GAAP metrics without unreasonable effort.

5. Net Debt to Adjusted EBITDA ratios are non-GAAP financial measures that are frequently used by investors and credit rating agencies to provide relevant and useful information. AT&T’s Net Debt to Adjusted EBITDA ratio is calculated by piding the Net Debt by the sum of the most recent four quarters Adjusted EBITDA. Adjusted EBITDA estimates depend on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between Adjusted EBITDA and the most comparable GAAP metric without unreasonable effort.