Netflix’s chances of closing a deal for Warner Bros. Discovery appear to be slipping as rival bids and new financial guarantees from Paramount Skydance shake up the race.

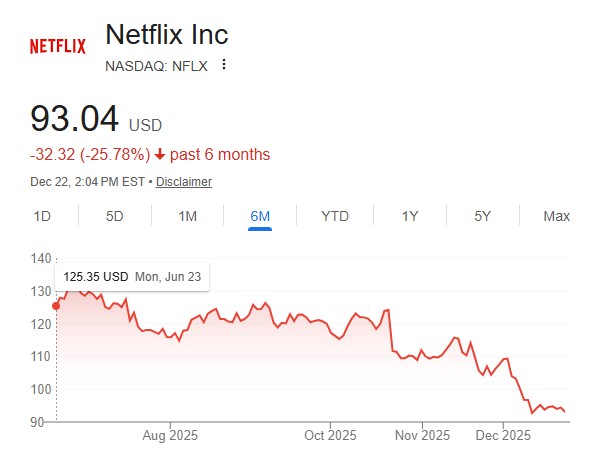

Netflix Odds Slide on Polymarket

According to Polymarket, a decentralized prediction market where users bet on real-world outcomes, the odds of Netflix completing a deal for Warner Bros. Discovery have fallen sharply.

The market now puts Netflix’s chances at 61%, down from 80% just days ago, signaling growing skepticism among traders that a deal gets done.

Likewise, on the Kalshi app, the odds of Netflix successfully taking over Warner Bros. are only at 53%, while Paramount’s odds have been raised to 44%.

The shift comes as competing offers gain momentum and questions surface about valuation and deal structure.

JUST IN: Netflix's $NFLX odds of closing the Warner Brothers deal falls from 80% to 61% on Polymarket. pic.twitter.com/dBExzwv3yE

— Watcher.Guru (@WatcherGuru) December 22, 2025

Ellison Guarantees Billions for Rival Offer

Following reported concerns from the WBD board, Paramount disclosed in an SEC filing that Larry Ellison has personally stepped in to backstop financing tied to the competing bid.

“Larry Ellison has agreed to provide an irrevocable personal guarantee of $40.4 billion of the equity financing for the offer and any damages claims against Paramount,” the filing states.

The move strengthens the Ellison-backed proposal and raises pressure on Warner Bros. Discovery’s board as it weighs competing paths forward.

WBD Board Said to Favor Netflix Structure

According to NY Post business reporter Charles Gasparino, insiders believe Warner Bros. Discovery may still view Netflix’s offer as superior, despite the Ellison guarantee.

Gasparino reports that Netflix’s cash-stock proposal includes additional value tied to the equity stub from a cable-asset spinout, which would include CNN and Discovery as a new publicly traded company.

It’s reported that WBD is valuing that equity stub at around $4 per share, pushing the effective value of the Netflix deal close to $32 per share.

The Ellison group reportedly argues that valuation is inflated, claiming anything above $2 per share is unrealistic, even as they signal a willingness to raise their bid by up to 10% and cover any Netflix breakup fee.

BREAKING: So this is me combining some reporting and doing a little spit-balling of the @wbd – @paramountco–@Skydance–@netflix drama: My guess is that @wbd comes back with a "pound sand" response to Larry Ellison's latest in personally backstopping his son's $30 all cash offer…

— Charles Gasparino (@CGasparino) December 22, 2025

Bidding War Limits in Sight

Gasparino also notes there are limits to how far Netflix is willing to go, especially given its recent stock performance.

If the Ellison-backed bid climbs into the mid-$30 range, sources for Gasparino inside WBD say the company would be duty-bound to seriously consider shifting course.

With multiple offers in play and market confidence wavering, the outcome of the WBD deal is becoming far less certain.

Update: Warner Bros. Discovery’s board of directors says it will “carefully review and consider” Paramount’s revised bid for the company. The company confirmed it received the updated tender offer on Monday evening:

“Warner Bros. Discovery will review the Amended Tender Offer and advise its stockholders of the Board’s recommendation after the completion of that review,” the company said, adding that the board, “consistent with its fiduciary duties and in consultation with its independent financial and legal advisors, will carefully review and consider Paramount Skydance’s offer in accordance with the terms of Warner Bros. Discovery’s agreement with Netflix, Inc.”